Introduction

In March 2022 the Public Service Unions of the ICTU (PSC) invoked the Review clause in Building Momentum because of high and sustained inflation, which was not anticipated when the agreement was negotiated in late 2020.

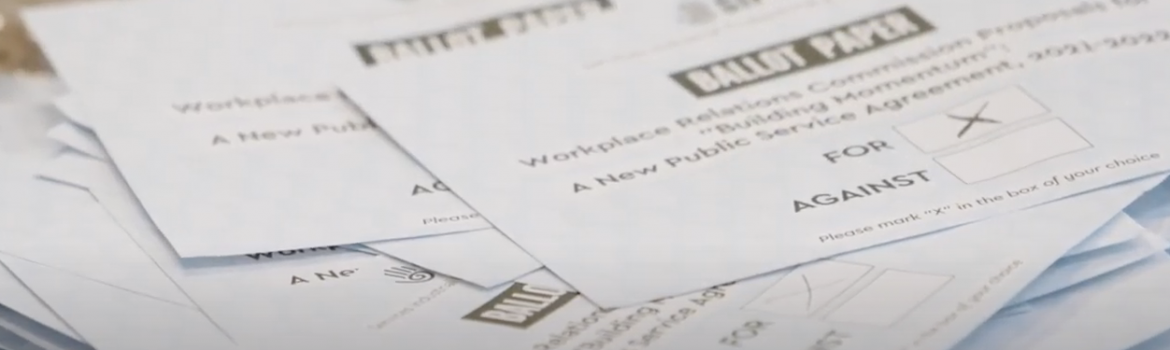

On 30th August 2022, the Workplace Relations Commission (WRC) published proposals for a public service pay package aimed at resolving differences on pay between public service unions and the Government.

The PSC met and agreed that individual unions should consult and ballot their members on the proposals. The PSC will meet again on 7th October 2022 to make a collective decision on whether to accept or reject the package.

What are the pay proposals being balloted on now?

The package would make the following pay adjustments:

• 3% with effect from 2nd February 2022

• 2% with effect from 1st March 2023

• 1.5% or €750 a year (whichever is the greater) with effect from 1st October 2023. The €750 a year floor means those on lower incomes will receive a larger percentage increase than higher paid staff (see below).

Is this in addition to existing Building Momentum pay adjustments?

Yes. The WRC-proposed increased would come on top of those paid and scheduled under the original Building Momentum agreement.

These are:

• 1% or €500 a year (whichever is the greater) from 1st October 2021. This floor of €500 provided higher percentage increases to workers on lower incomes.

• The equivalent of 1% increase through sectoral bargaining from 1st February 2022. This fund was used as a general pay round (PAC Division) and to address long-standing claims with the Health Division.

• 1% or €500 a year (whichever is the greater) from 1st October 2022. Again, the €500 floor means those on lower incomes will receive a larger percentage increase than higher paid staff (see below).

How do lower paid workers benefit more?

In percentage terms, the package is worth an additional 6.5% between February 2022 and December 2023, on top of existing Building Momentum pay adjustments.

But the cash floor of €750 (in October 2023) means a higher percentage increase for workers who earn below €50,000. This includes special needs assistants, most clerical staff, and general operatives.

For example, the salary level of a person earning €25,000 a year would increase by 8% and the salary level of a person earning €37,500 would increase by 7%.

These measures when taken in conjunction with the provisions of Building Momentum provide significant increases to workers on lower incomes.

When would I receive the 3% increase due in February 2022?

If the package is accepted, the first additional increase of 3% will be backdated to 2nd February 2022. This would appear in pay packets as a ‘lump sum’ back-payment after the agreement is ratified. This would likely be in November or December 2022.

Are there additional non-pay elements to the package?

While there are no additional non-pay elements in this specific package, the Government came to the negotiations promising that economy-wide cost-of-living supports would accompany any pay improvements. These are expected to come through the 2023 Budget announcement (scheduled for 27th September 2022) and the Labour-Employer Economic Forum (LEEF), which is Ireland’s main national forum for social dialogue between unions, employers and Government.

Does the WRC package affect sectoral bargaining under Building Momentum?

No. The ‘sectoral bargaining fund’ established under the original Building Momentum agreement is not affected by the WRC proposals. Groups of public servants that opted to use this 1% fund to address outstanding adjudications, recommendations, awards and claims relevant to specific grades, groups or categories of workers will continue to do so. Groups that opted to use the allocation as a straight 1% payment have either received it, or are due to receive it with effect from 1st February 2022.

Do the pay improvements apply to allowances?

The increases would apply to pensionable allowances and the higher hourly rates will also benefit through recently-restored overtime/on call allowances.

What about part-time workers, job-sharers, etc?

If the proposed agreement is accepted, pay adjustments will be delivered through revised pay scales. Part-time workers and others who don’t work full-time hours will get pro-rata adjustments based on the number of hours they work.

Who would the package apply to?

The package would apply to workers currently covered by the Building Momentum agreement, including staff directly employed in the civil or public service, staff in ‘section 38’ agencies, and staff in Non-Commercial State Agencies.

Are there any productivity measures in the package?

There are no additional productivity measures in the WRC-proposed package. It reaffirms the measures in the original Building Momentum agreement.

What is the duration of the WRC-proposed package?

The package would extend the duration of Building Momentum by one year, so that it would expire on 31st December 2023. Unions would expect to be in negotiations on a successor agreement around the middle of next year.

How would this affect public service pensioners?

Under public service agreements, increases in public service pay scales are generally reflected in public service pensions that are linked to pay scales. The PSC has written to the Minister for Public Expenditure and Reform seeking confirmation that, if accepted, this will apply to the WRC-proposed package in the usual way.

How will a decision on accepting or rejecting the package be reached?

Individual ICTU-affiliated unions representing public servants are now consulting with their members and arranging ballots. The unions will meet again to take a collective decision on whether to accept or reject the package on Friday 7th October. Voting at that meeting will be weighted to reflect the number of public servants that each union represents.

What about planned industrial action ballots?

The ICTU Public Services Committee (which represents most unions in the sector) has recommended that planned industrial action ballots be suspended while unions consult on the WRC package.